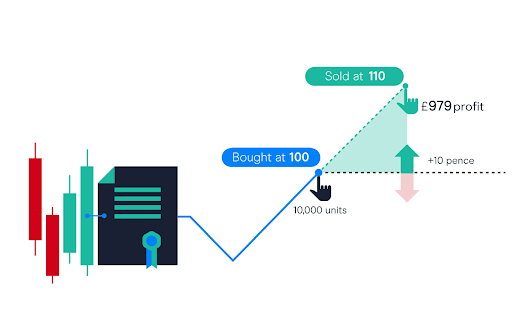

CFD trading is a flexible investment method, but it cannot be evident if you’re new to it. In simple terms, you buy or sell contracts for difference (CFDs) that represent the asset’s price movement and therefore gain profit or loss based on its fluctuations in price.

The benefits of CFD trading are numerous. For example, you can trade on a wide range of stocks and indices with a small initial investment. This article will look at the advantages of CFD trading and explain how you can make it work for your trading strategy.

1. Higher Leverage in Trades

One of the most significant advantages is your increased leverage with CFD trading. You only need to put down a fraction of the total value of your trade to make a profit, which is why CFD traders can benefit from increased returns on their investments. For example, if you placed a $10,000 bet on the price of gold rising over the next year, you would only have to put down $500 (5% of the total price) if you used CFDs.

CFD trading enables investors to trade on margin and make use of leverage. Leverage allows investors to control more prominent positions with smaller amounts of capital, thereby providing the ability to invest in assets that would otherwise be out of reach.

You can increase your profit potential or minimize losses when markets move against you negatively due to unforeseen factors outside your control. While CFD trading sounds like an attractive proposition, it also comes with some risks: if those assets lose value, the losses could exceed your initial investment and put you at risk of losing all of your money.

2. Penetrate Global Market

CFDs allow traders to access global markets from one platform, making it easier to manage multiple portfolios without logging into various accounts. In addition, since CFD trading provides global market access from a single platform, traders can more easily manage their portfolios by eliminating the need for tedious research and analysis across multiple accounts and platforms.

This benefit benefits those who want to expand their business into new markets but are limited by their current financial resources or lack of knowledge about foreign exchange rates. In addition, CFD trading can help if you trade on multiple platforms but want to consolidate your accounts into one place.

3. No Day Trading Requirements

Certain marketplaces impose minimum capital requirements to handle day trades. In addition, day traders are also subject to daily trading limits as put forth by their accounts. In such cases, CFD trading comes in handy as it requires no minimum capital requirement and is not limited by daily trading limits.

So you have the freedom to trade at any time with CFD trading if there is an open market for the underlying asset in question. Some banks allow you to open a forex trading account for as little as $1,000. However, the average minimum deposit requirement is usually about $2000 to $5000.

4. Flexible Lot Sizes

For most traders, lot sizes play an important role in determining how much of their capital they risk in a single trade. While most forex platforms have strict requirements for trading lots, CFD brokerage companies often allow traders to enter trades with different lot sizes. This flexibility makes CFD trading an attractive option for those who prefer not to trade using fixed-value orders.

CFD trading allows for greater flexibility of lot sizes than traditional trading. That’s because a spread is defined in terms of the difference between the bid price and ask price, and this difference can be small enough to allow for deals with small lot sizes.

If you’re a newbie, you might just want to stick with a smaller lot size in CFD trading. This way, you can limit your risk exposure and keep things simple. In addition, you can start with a small lot size and gradually increase it as your confidence grows.

5. No Expiration Date

CFDs don’t lose value over time. They differ from future contracts as there are no limits or strict regulations on closing a position. Since CFD trading has no expiration date, you can hold onto your position indefinitely. If there is still value in your position at any given time, you can hold onto it forever (or until you decide to close it).

Traders who want to make long-term investments should be patient. As a day trader, you will not enjoy profit from short-term investments in CFD trading. Therefore, make a long-term plan for your investment and observe a few market cycles to ensure you sell at the right moment for the right price.

6. Better Hedging Positions

Hedging is when you buy or sell another asset to offset some of the risk associated with your original investment. Since you need limited capital to open your positions in CFD trading, you can use the remaining funds for hedge positions and control your risk.

You can use hedging to protect yourself against unexpected price movements or to capitalize on expected price movements. Instead of selling for a loss and exhausting your funds, you can now open new positions as an additional source of income to balance your initial investment. As a result, you can mitigate some CFD trading risks that come with:

- Low industry regulation

- Lack of liquidity

- Adequate margin requirement

- Complex trading tools

- Counterparty risk

- CFD Clauses

Final Words

CFD trading is attractive for both professional and beginner traders since it allows them to generate higher profits with less capital. However, it also increases risks because margin requirements increase volatility, and losses can be amplified when prices move against them during market stress or volatility spikes.

So CFD trading should be used with caution by experienced investors who know how these markets work before risking their money with this strategy.