In the next decade or so, the U.S. and many countries in Western Europe are going to undergo what is being dubbed “the biggest wealth transfer in history.” The expected transfer of wealth is driving this from aging baby boomers to their heirs. While this will be in a windfall for millions, the process is fraught with danger not only because it will be unequal but also because the many families will not have the structures needed to shield their assets from the taxman.

This is happening because the Baby Boomers, those born between 1944 and 1964, have accumulated close to $30 trillion in wealth and are expected to start transferring much of their wealth in the coming years. Financial journalists have already begun to take notice of this, and with that observation has come a slew of articles on the subject.

But what does this mean for you? Well, if your parents or grandparents have amassed a tremendous amount of wealth, then you are likely to receive a windfall. However, this is not guaranteed as missteps in the process could end up costs you in terms of taxes or delays in probate.

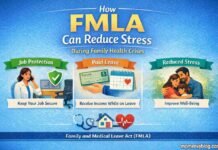

Next to limiting an estate’s tax liability, avoiding probate is the most essential thing that can be done to make sure you benefit from the biggest wealth transfer in history. The reason why you want to steer clear of probate is that the process can be expensive and can take a long time.

The good news is that many of these delays can be avoided if a person’s estate is correctly structured in advance. Doing this will ensure a smooth transition of assets, without the need to get a probate court involved

However, this is not something you want to do on your own – especially if there are millions of dollars at stake. Instead, you want to enlist the aid of attorneys and accountants who specialize in creating a thorough estate plan that will stand the test of time.

Keep in mind, having these discussions with elderly parents and grandparents is not easy. Yet, it is something that you should do as it will not only give them peace of mind, but it will ensure that the beneficiaries of their estate understand what their wishes are before it is too late. Only in this way can you make sure that the family benefits from the wealth that has been accumulated over the years.

Stepping back, how have we gotten to this point? For starters, those born after World War II have lived during the most explosive time of economic growth known to humanity. After the destruction of the Great Depression and the subsequent war, the years since have been some of the most peaceful and stable in our history.

Add to this the rapid increase in property values in recent years, and what we have witnessed is a massive accumulation and consolidation of wealth. As millions of Baby Boomers begin to reach old age, much of that wealth is positioned to be passed to the next generation.

This brings us to another question. What does this wealth transfer mean for you? The answer largely depends on the financial situation of your family. If the Boomers in your family were able to take advantage of the relative economic stability of the post-war period, then there is a possibility that some of that wealth will be passed onto you.

However, this is not the case for everyone as the income and wealth gaps will see many families left behind for good once the transfer begins. Also, there is no guarantee that much of the wealth on paper can ever be realized. This is because much of the wealth held by Baby Boomers are either tied up in their homes or the stock market.

In terms of home values, the good news is that prices in many areas have been relatively unchanged due to COVID. Home values in the suburbs surrounding New York City have gone up in recent months as people seek to exit the city following what happened there during the lockdown.

As for the money tied up in the stock market, things are incredibly good right now, maybe too good, and this could be a sign that aging Baby Boomers may need to shift some of their holdings into cash or other liquid assets before a correction happens. If not, then we could be looking at a situation like when the dot com bubble burst, and this could mean that many people could lose everything.

The biggest wealth transfer in history is about to happen. While the process will not be equitable, it will represent a potential windfall for millions. To make sure you can benefit, you should talk to your family and make sure that there is a plan in place to shield as many assets as possible from taxation, probate, and uncertainties in the market. While this is a bit of a moving target, if you and your family want to benefit, then you need to start setting everything up today.