In Hamlet, Shakespeare says, “Don’t borrow money and don’t lend it, since when you lend to a friend, you often lose the friendship as well as the money…” We can use this quote to often identify the problem of lending money to friends and relatives. Since there is no regulatory body of the loan, such as is in the case of institutes within the credit industry namely banks and loan companies, repayments can come in chaotically.

Err on the Side of Caution

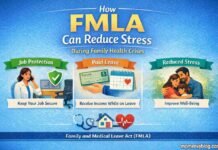

While it might make sense emotionally to lend money to close friends and family, other options exist which might prove to be more practical. Directing them toward using the services of perhaps loan companies, could prove to be the responsible thing to do.

Yes, they will incur interest costs, but the repayment discipline may be far more beneficial to them than simply handing them money with open-ended terms.

Crediful.com indicates that consolidation loans might be a better option for those who are experiencing financial difficulties. This way family and friends can better their situation by taking financial control and improving their credit history.

Weighing the option of providing assistance to a loan application or providing the funds yourself is not heartless. It’s finding a practical solution to a problem that might lead to emotional erosion.

Loans Between Friends Do Not Expire!

When you go to the bank to apply for a loan, there are specific clauses, interests and repayment periods that require fulfillment.

“Pay me back when you can…” this sentence certainly appears to be a ‘poke’ at the individual and their circumstances. However, without establishing an expiry date or a small condition to the friend who is or will be indebted to you, the loan goes into the background. It’s often best to avoid having to play a private eye in order to get your money back. The sense of uncertainty can be very difficult to bear for both parties. A repayment deadline is the best to establish prior to providing the loan.

To avoid these embarrassing situations, if you do decide to lend a sum of money to a family member, it is necessary that this is an agreement that closes exclusively between the two parties, without reporting anything to the rest of the family unit.